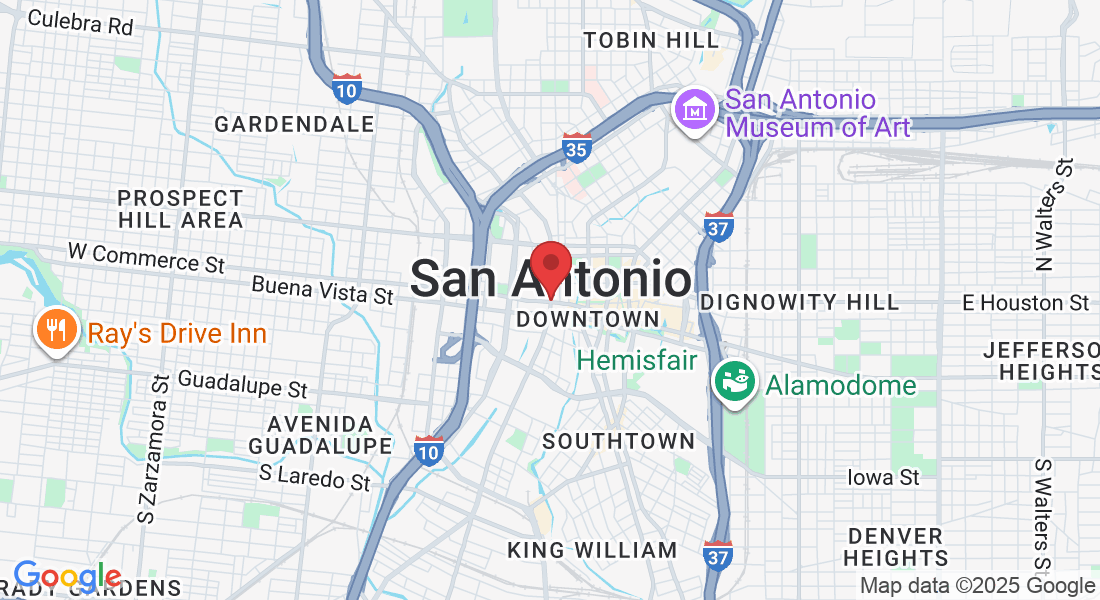

Simplified Insurance Solutions for Your Peace of Mind

When navigating the complexities of Medicare, health, and life insurance, having proper guidance is crucial.

At Texas Insurance for You, we take pride in delivering straightforward, pressure-free advice tailored to your needs.

Whether you're planning for yourself or a loved one, scheduling a call with us ensures you receive clear, personalized solutions that make the process of choosing the right benefits a stress-free and straightforward process.

Unmatched Expertise and Care in Insurance

At Texas Insurance for You, we are dedicated to providing exceptional customer service by prioritizing clarity, compassion, and expertise. Our knowledgeable team, backed by years of experience and a genuine passion for helping others, ensures that every interaction is seamless and meaningful. We believe in making benefits easy to understand and tailored to your unique needs, all without the pressure of pushy sales tactics. Your satisfaction and peace of mind is our top priorities.

Expert Guidance for Informed Medicare Decisions

At Texas Insurance for You, we believe your benefits should be simple and straightforward, without any pressure. With our Texan Senior Benefits Advocates, you're more than just a policy number. We offer personalized advice to help you understand and select the most suitable Medicare and retirement options for you and your family. Our approach is centered on empowering you with knowledge, so you can make choices with confidence, without the hassle of sales calls or one-size-fits-all plans.

Instead of being inundated with sales pitches, our clients receive thoughtful, customized solutions. Unlike other agencies or online quoting tools, we listen deeply to your needs and guide you through every step of the decision-making process. Trust in a local expert who values clarity, integrity, and your best interests.

Simplifying Your Health Insurance Journey

At Texas Insurance for You, we're committed to making your benefits simple and straightforward, without the hassle of pushy sales tactics. If you're exploring under-65 health insurance, wealth, or retirement options, we're here to guide you with personalized, professional advice. Our approach is designed to help you find the solutions that truly fit your needs, rather than overwhelming you with countless calls and limited options.

Unlike generic quoting tools or unfamiliar agencies, we prioritize your understanding and confidence. Our experienced team listens to your specific concerns and offers advice that aligns with your goals, all while ensuring you understand important details like potential PPO restrictions.

Secure Your Future with Confidence

At Texas Insurance for You, we understand that choosing Life insurance is a deeply personal decision. We stand apart by offering personalized consultations that focus on understanding your unique needs and providing comprehensive solutions—without the pressure or relentless follow-ups. By booking a call with us, you'll receive expert guidance tailored to your specific circumstances, ensuring that you make choices that truly benefit you and your loved ones. Experience service that prioritizes your peace of mind, delivered by someone who genuinely cares.

SHOP Health Plans Made Simple for Texas Businesses

At Texas Insurance for You, we help small business owners simplify employee health benefits through theSHOP Marketplace (Small Business Health Options Program). Managing healthcare for a team can be overwhelming—especially with varying plan options, contribution levels, and compliance requirements. That’s why we take a personalized approach, ensuring every Texas business owner finds a solution that’s flexible, affordable, and tailored to their workforce. Whether your company has W‑2 staff, 1099 contractors, or a mix of both, we’ll guide you through the best options available, balancing cost savings with meaningful coverage. With us, you’ll receive clear, pressure‑free guidance and support that keeps your focus where it belongs—on growing your business.

Global Travel Health Coverage for Texans on the Move

From weekend escapes to global business trips, travel brings opportunities—and unexpected risks. At Texas Insurance for You, our Global Travel Health Insurance is designed to protect Texans worldwide with coverage for emergency medical care, trip cancellations, lost baggage, and more. Unlike limited domestic plans, our travel protection extends beyond borders, ensuring you’re cared for wherever your journey takes you. We tailor each policy to your destination, trip length, and activity level so that you never pay for coverage you don’t need or overlook details you do. Whether you’re an adventurer, business traveler, or family exploring abroad, our experts deliver clear, comprehensive solutions—without the sales pressure. Travel confidently, knowing that if the unexpected happens, you’re safeguarded by a local Texas team that truly cares

Testimonials

Texas Insurance for You guided me through my Medicare options with understanding and patience. They took the time to explain everything, answering every question without making me feel rushed or pressured. It was clear they genuinely care about their clients, not just selling a plan.

I dreaded retirement planning until I started working with Texas Insurance for You. Instead of pushing a one-size-fits-all solution, they crafted a plan that truly fit my financial situation and future goals. I appreciate their thoughtful, client-first approach.

Trabajar con una agencia local significó muchísimo para mí; lo entienden. Texas Insurance for You ofrece un trato personal que te hace sentir valorado y respetado, no solo como un número más. Es reconfortante tener a alguien de tu lado que realmente te escucha.

In a market full of pushy sales tactics, Texas Insurance for You stands out for their honesty and transparency. They laid out all my health insurance options clearly, helping me choose a plan that meets my specific needs. I never felt pressured—only supported.

Texas Insurance for You empowered me to make informed decisions about my future. They offered guidance without taking control, respecting my need to fully understand and take charge of my Medicare and retirement planning. They truly appreciate their clients.

I loved how easy it was to communicate with Texas Insurance for You. They were always available to answer my questions, and their straightforward communication style made complex topics easier to understand. I felt in control and informed every step of the way.

What makes Texas Insurance for You different from other Insurance Agencies?

Texas Insurance for You stands out by offering a personalized, pressure-free experience that respects your privacy and preferences. Unlike the generic quoting tools or agencies that bombard you with calls, we focus on understanding your specific needs and providing comprehensive advice across Medicare, health, life, and ancillary products. Our award-winning approach ensures that you’re dealing with a local Texas expert who values long-term relationships over quick sales. With us, you can expect clear communication and tailored solutions without the relentless follow-up calls, making it a much more comfortable and trustworthy experience.

Medicare FAQ

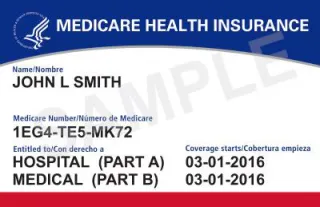

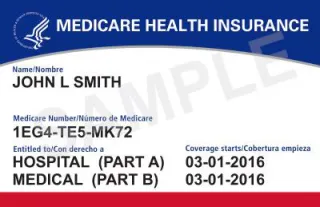

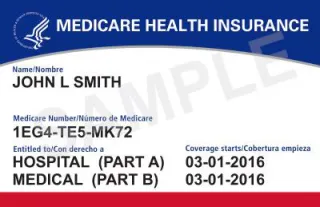

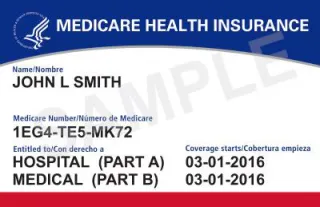

What is Medicare and who is eligible?

Medicare is a federal health insurance program primarily for those aged 65 and older, along with some younger individuals who have disabilities. If you're newly eligible or have questions, Texan Senior Benefits Advocates can guide you through eligibility requirements. When should I enroll in Medicare? Initial enrollment begins three months before you turn 65 or when you become eligible. If you’re unsure about enrollment periods, our team can help you understand your timelines, or you can find specific details on Medicare.gov.

What's the difference between Original Medicare and Medicare Advantage?

Original Medicare includes:

Part A (hospital insurance)

Part B (medical insurance)

while Medicare Advantage (Part C) offers an alternative through private companies with additional benefits.

We can help explain which option might be best for you.

When should I enroll in Medicare?

Initial enrollment begins three months before you turn 65. If you’re unsure about enrollment periods, our team can help you understand your timelines or you can find specific details on Medicare.gov.

What does Medicare Part A cover?

Part A covers inpatient hospital stays, skilled nursing facility care, and some home health care. Our team can explain the specifics, or you can check coverage details online.

What does Medicare Part B cover?

Part B covers doctors' services, outpatient care, and preventive services. We provide a simple breakdown, and further information is available on Medicare.gov.

How does Medigap work?

Medigap is supplemental insurance that helps pay for costs not covered by Original Medicare, like copayments and deductibles. We offer personalized advice on choosing a plan.

What about prescription drug coverage?

Medicare Part D covers prescription drugs, either as a standalone plan or through Medicare Advantage. Reach out to us for help navigating your options.

How do I change my Medicare plan?

Changes can typically be made during open and special enrollment periods. We can discuss your needs and help you find the best fit.

Who can I talk to for personalized Medicare advice?

Texan Senior Benefits Advocates is here to offer tailored advice without the sales pressure. You can also explore resources and tips onMedicare.govfor additional guidance.

Health Non-Medicare Frequently Asked Questions

What health insurance options are available for Texans under 65?

Under 65, you can choose from ACA Marketplace plans, employer coverage, short-term PPOs, or sharing ministries. Marketplace plans are the most comprehensive, especially if you qualify for subsidies to lower premiums.

How does the Affordable Care Act (ACA) help Texans?

The ACA guarantees coverage for pre-existing conditions, offers preventive care with no added cost, and provides income-based premium assistance. Many Texans qualify for lower premiums or even $0 silver plans.

What’s the difference between on-exchange and off-exchange plans?

On-exchange plans are offered through the federal Marketplace with possible tax credits. Off-exchange plans come directly from insurance companies — sometimes with more flexibility but no subsidies.

Are short-term health plans a good option?

They can fill temporary gaps but aren’t full ACA coverage. They may exclude pre-existing conditions and have benefit caps. Always review exclusions carefully before signing up

What happens if I miss open enrollment?

You may still qualify for a Special Enrollment Period if you’ve had a major life change — like losing coverage, getting married, or having a baby. Otherwise, short-term plans can serve as a bridge.

Can I use my current doctor with any plan?

Not always. Network availability is key — HMOs and EPOs limit options more than PPOs. Before buying, check whether your preferred providers are in-network.

How do deductibles and copays work?

A deductible is the amount you pay before your insurance kicks in. Copays are smaller, fixed fees for services like office visits or prescriptions. Higher deductibles usually mean lower premiums.

How do I choose the right plan type in Texas?

Compare monthly premiums, deductible amounts, and coverage networks. If you frequently see doctors, a lower-deductible plan may save money long term; if you’re healthy, a higher deductible could lower monthly costs.

What’s the deal with “PPO” health plans promoted on social media?

Many “nationwide PPO” ads are misleading. They often sell indemnity or “discount” plans disguised as PPOs. These pay a fixed amount per service — not your total bill — leaving clients with unexpected thousands in unpaid costs.

How can I avoid health insurance scams in Texas?

Only buy from licensed agents or verified companies. Be cautious of ads promising “no deductible, full coverage PPOs” at low prices. Real health insurance must comply with Texas and ACA regulations. When in doubt, call a trusted professional — someone whose motto is simple: Your benefits, made simple, no pushy sales.

Life & Final Expense FAQ

How do I determine the right amount of coverage for life and final expense insurance?

Determining the right coverage ensures your loved ones are financially secure.

When considering life insurance, consider factors such as income replacement, mortgage payments, debts, education expenses, and retirement needs.

For final expense insurance, focus on expected funeral costs, medical bills, and outstanding debts.

Using these considerations helps build a solid safety net tailored to your family’s unique situation, ensuring comprehensive support.

What types of life insurance are available, and how do I choose the best one for my needs?

Choosing the right life insurance can feel daunting, but understanding your options helps.

Term life insurance offers coverage for a specific period, often appealing to budget-conscious buyers focused on temporary needs.

Whole life insurance provides lifelong coverage with cash value accumulation.

Universal life offers flexibility in premiums and death benefits.

Final expense insurance specifically addresses end-of-life costs, providing peace of mind for you and your loved ones. Consider your financial goals, current life stage, and what you wish to protect when deciding.

Who qualifies for life and final expense insurance, and what factors affect my premiums?

Qualification criteria are generally welcoming, especially for final expense insurance, which often accommodates older adults and those with health conditions.

Factors influencing premiums include age, health, lifestyle choices, and the type of coverage selected.

Understanding these elements equips you with the knowledge to choose coverage that fits your needs and budget, while also highlighting areas where lifestyle adjustments might lower costs.

Can I adjust my life insurance policy if my needs change over time?

Life circumstances can change, and it’s natural to wonder about policy flexibility.

Many life insurance policies allow adjustments.

For instance, you might convert a term policy to a whole life one, or increase/decrease your coverage as needs shift.

Discussing these possibilities with an advisor can provide clarity and ensure that your coverages evolve with your life, offering continued peace of mind.

What types of life insurance are available, and how do I choose the best one for my needs?

Choosing the right life insurance can feel daunting, but understanding your options helps.

Term life insurance offers coverage for a specific period, often appealing for budget-conscious buyers focused on temporary needs.

Whole life insurance provides lifelong coverage with cash value accumulation, while universal life offers flexibility in premiums and death benefits.

Final expense insurance specifically addresses end-of-life costs, providing peace of mind for you and loved ones. Consider your financial goals, current life stage, and what you wish to protect when deciding.

What are the implications of missing a premium payment, and how do payouts work?

Missing a premium payment can be concerning, but rest assured, policies usually include grace periods to help. Should lapses occur, there are often options to reinstate coverage. Upon an insured's passing, beneficiaries typically receive payments directly and promptly, providing essential financial support without dictating how the funds are used. Understanding these processes ensures you’re well-prepared to manage your policy effectively throughout its duration.

Global Health and Emergency Travel FAQ

What is global health insurance, and how is it different from regular travel insurance?

Global health insurance offers comprehensive worldwide medical coverage, including preventive care, hospital stays, and long-term treatment. Travel insurance, on the other hand, focuses on short-term emergencies such as unexpected illness or injury during a trip.

Who should consider global health or emergency travel insurance?

These policies are ideal for frequent travelers, business professionals, expatriates, international students, and retirees who spend extended time abroad.

Are pre-existing medical conditions covered?

Coverage for pre-existing conditions depends on the plan. Some policies may include limited coverage or require a waiting period, while others may exclude them. Our team will review your options to ensure you understand all details before enrolling.

How does emergency travel assistance work while abroad?

You receive a dedicated 24/7 global response team offering on-the-spot coordination for medical emergencies, travel disruptions, or security-related evacuations.

Can I choose my own doctors and hospitals overseas?

In most global health plans, you can access any licensed provider worldwide, with additional savings when using network hospitals or clinics that handle direct billing.

How long can I be covered under emergency travel insurance?

Coverage can range from a single trip to annual multi-trip plans. We help you choose a policy that best matches your travel frequency and destination needs.

What destinations are covered under your global insurance plans?

Our plans typically offer worldwide coverage, including the United States, although some may exclude high-risk areas or require approval for travel to specific countries.

How do I file a claim if I have a medical emergency abroad?

Contact your plan’s 24-hour emergency team immediately. They will help authorize care, manage direct payments to the hospital if covered, and guide you through documentation for reimbursement.

Can coverage extend to my spouse or family members traveling with me?

Yes, family or group policies can include partners and dependents. We’ll help you structure a plan to keep everyone protected under one policy.

How can I get started or request a personalized global insurance quote?

Simply contact Texas Insurance for You through our website or call directly. Our friendly Texas-based team will walk you through options, benefits, and pricing to match your travel goals.